Impact Investing

The Barra Foundation began experimenting with impact investing in 2016. Just as we fund organizations that test and learn from novel approaches, we are walking that walk with impact investing.

Most foundations are required by law to distribute five percent of the value of investment assets each year to charitable and administrative purposes.

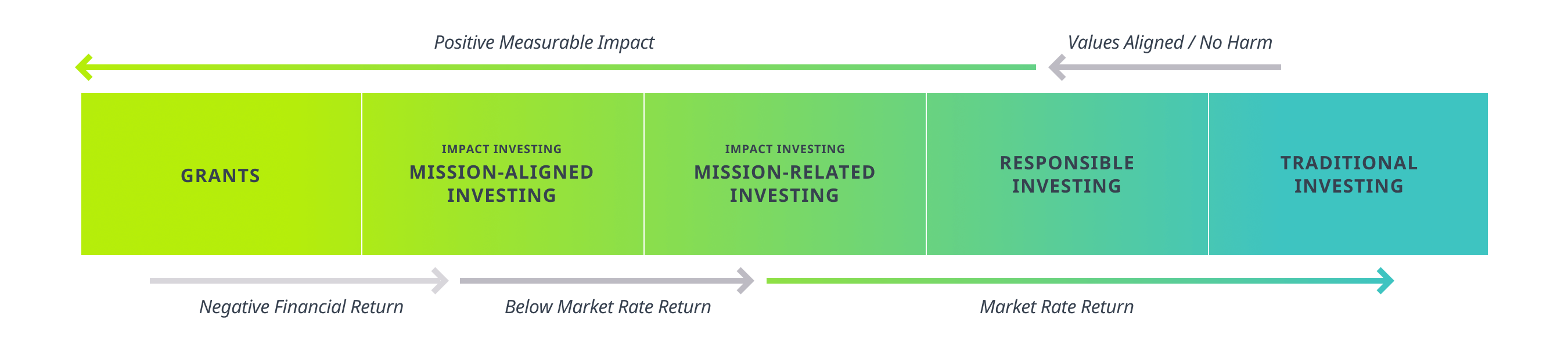

At Barra, we see impact investing as an opportunity to leverage the other 95 percent. The language and definitions for impact investing are continuing to evolve, but Barra has focused its efforts on these categories:

Impact Investing

- Mission-Aligned Investing (MAI): below-market rate investments that are primarily made to advance the charitable purpose of the foundation. Learn more about our mission-aligned investments.

- Mission-Related Investing (MRI): investments that have an intentional and measurable social or environmental impact.

Responsible Investing (RI)

- Market-rate, values-aligned/do-no-harm investing. Along with others in the field, Barra does not consider this impact investing (because it is not always intentional and measurable), but it is part of our overall strategy to align our money with our mission and values.

Barra has committed 95% of our endowment to these three categories (5% in MAI, 15% in MRI and 75% in RI). As Barra continues to build our impact investing portfolio, we will be adding information to this section of our website. For now, the work that we share focuses on the mission-aligned component of our portfolio, which is focused in our five-county region and is most closely aligned with our charitable mission.